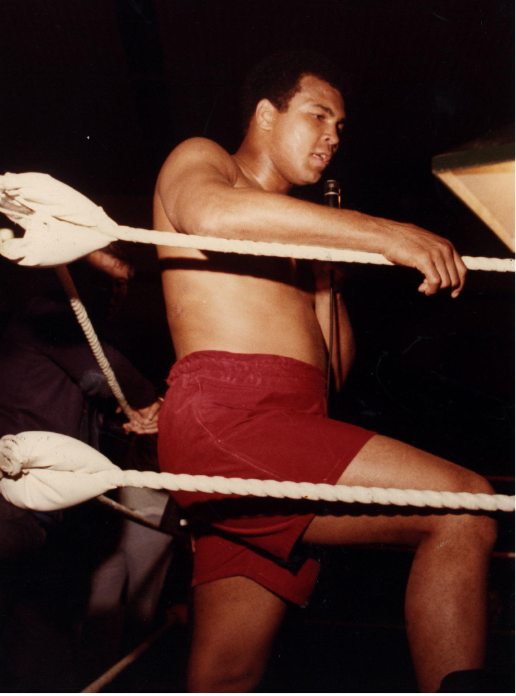

ESG – a knockout, or a case of “rope-a-dope”?

2023 was a year in which global greenhouse gas emissions reached a new high of nearly 60 Billion T CO2e (Brookings), on the back of similar, record highs in crude production and demand. Billions in future investment was made available for major projects like Lapa and BM C 33 in Brazil, Sparta, Trion and Dover in the Gulf of Mexico, Uarau in Guyana, Neptun Deep in the Black Sea, Rosebank in the UK and Hail and Ghasha in the UAE (Offshore-Energy.com). Coal fired electricity continued to dominate the global electricity mix as it reached a new record (Rystad) and in the first half of 2023 alone, just in China, nearly 100GW of new coal capacity was permitted or announced. 2023 finished with atmospheric carbon sitting just under 420ppm compared with its pre-industrial level of 280ppm, temperatures in 2023 hit record levels since modern records began in1850, soaring 1.2’C above the 20th century average.

Market efforts to counter the harmful rise of carbon struggled. On January 18th, the Guardian newspaper in the UK commenced a series of investigative articles that attacked the weak state of carbon offsets, key carbon reduction and removal mechanisms integral to the Net Zero strategies of many corporates. Brazil’s Amazon started the year worsening from the previous year, despite the arrival of a new pro-climate action president. The sharemarket was not coming to the rescue either; by 2023, half of US States had introduced bills to choke back ESG investing and Larry Fink, head of the world’s largest fund manager Blackrock, pivoted away from his 2018 commitment to invest with “social purpose” and instead declared “I will not use the word ESG any more”, reacting to the charged and thankless political atmosphere that had embroiled the fund manager. Assets under management in ESG funds fell by about $163.2 billion globally during the first quarter 2023 (CNN), net outflows in the 2nd quarter reached $15B (Reuters Jul ’23).

Was this the year that we would witness climate, carbon offsetting and ESG entering their death throes?

Fortunately for climate goals, it was also the year the UAE’s COP28 Climate Conference delivered the first commitment to transition towards the end of fossil fuels”in a fair, orderly and equitable manner”. While time will tell how this impacts the transition, the COP also announced the potentially hugely impactful 2022 Inflation Reduction Act going into effect in the US, with up to $800 Billion USD (Credit Suisse assessment) in climate spending, in the form of a Green Bank, tax credits, investments and incentives in energy transition projects and sectors. Corporate appetite for Net Zero continued, with half of the world’s largest publicly-listed companies installing Net Zero targets by the end of 2023 (Net Zero Tracker), a 40% rise from the previous year.

Renewables continued their rise; around 300GW (IEA) of solar was added in 2023, a significant improvement on the existing 1200GW global capacity. Wind added more than 100GW, a more modest 10% addition, reversing an industry slump. Electric vehicle sales globally were expected to grow 34% by year-end, to 14Million units (EV-volumes.com), despite headwinds created by removal of subsidies, supply chain and regulator issues and a perceived slowing of US market uptake (where “slowing” still means 50% year on year growth).

Significant increases in hydrogen production, including low carbon hydrogen, were observed along with growth in the pipeline of hydrogen projects, volumes of fuelcell manufacture, and numbers of buses, trucks and light vehicles on fuelcells. Various innovative trials in maritime, aviation and rail commenced (IEA).

In one of the more significant moves in the area of reductions and removals, the US government finalised their new Methane Standards. This initiative promises to reduce methane related greenhouse gas emissions by 1.5 Billion T CO2e (USEPA) through a shake up of US oil and gas infrastructure management, accompanied by supporting capital and programmes.

The 143 Million T (climatefocus.com) voluntary carbon market indeed took a hit, particularly with reductions and avoidances (90% of the voluntary market), seeing an overall decline (Carbon Direct) but elsewhere the cup was “half full”. Forbes reported a 6.5x increase of credit sales for carbon removals, up from 800 thousand tonnes at the end of 2022. The backlash against offsets has been real but the consequence appears to be a move toward quality and integrity, not unreasonable directions to go . The favourable news continued in the regulated market, where European carbon price saw an all-time high of more than 100E/Tonnes before retracting again – an energy mix richer in renewables and a weak industrial outlook forced an inevitable easing in demand.

Developments in the engineered reduction space continued, 140 Million Metric tonnes of new Carbon Capture and Storage capacity was announced in 2023 (Bloomberg NEF), against around 45 Million Tonnes presently (IEA). Direct Air Capture remains small and exploratory at 0,01 Million T/yr but announced plans will increase the number of plants five-fold , delivering 75 Million T/yr by 2030 (IEA).

Despite the shaky year for ESG funds, 2023 fund volumes represented a massive increase over a short period, from $1,5Trillion to $5Trillion USD over 4 years to end 2023 (Lipper). Greenbond issuances were high and rising and average overall return for ESG funds was outperforming the 12-month moving average return for the wider market by 2.8 percentage points (CNN). Governments continued to move to address the transparency of sustainable investment accounting and marketing. For example the EU commenced the year with the new Corporate Sustainability Reporting Directive (CSRD) that expanded and started replacing the Non-Financial Reporting Directive (NFRD) to better clarify ESG impact vs risk management and align practices with new reporting, taxonomy and audit requirements (earlier taxonomy efforts may have contributed to ESG fund volatility, as managers reviewed their portfolios against the possibility of greenwashing or non-compliance). The EU concluded the year with a mandate seeking to improve consistency among ESG rating agencies.

All in all, based on 2023 developments, it would appear ESG, carbon and climate efforts are far from flatlining. However, efforts to improve continue to face significant opposition, while companies continue to face challenges in terms of complying with new requirements or capitalising on the opportunities. The road is heading in the right direction, but it’s not necessarily an easy one.

SnSD are positioned to partner with those wanting to explore or seize the opportunities on this sometimes wild ESG ride, whether in portfolio advice, climate strategy and reporting, or carbon opportunities. Talk to us about how we can help.

Josh Harrop